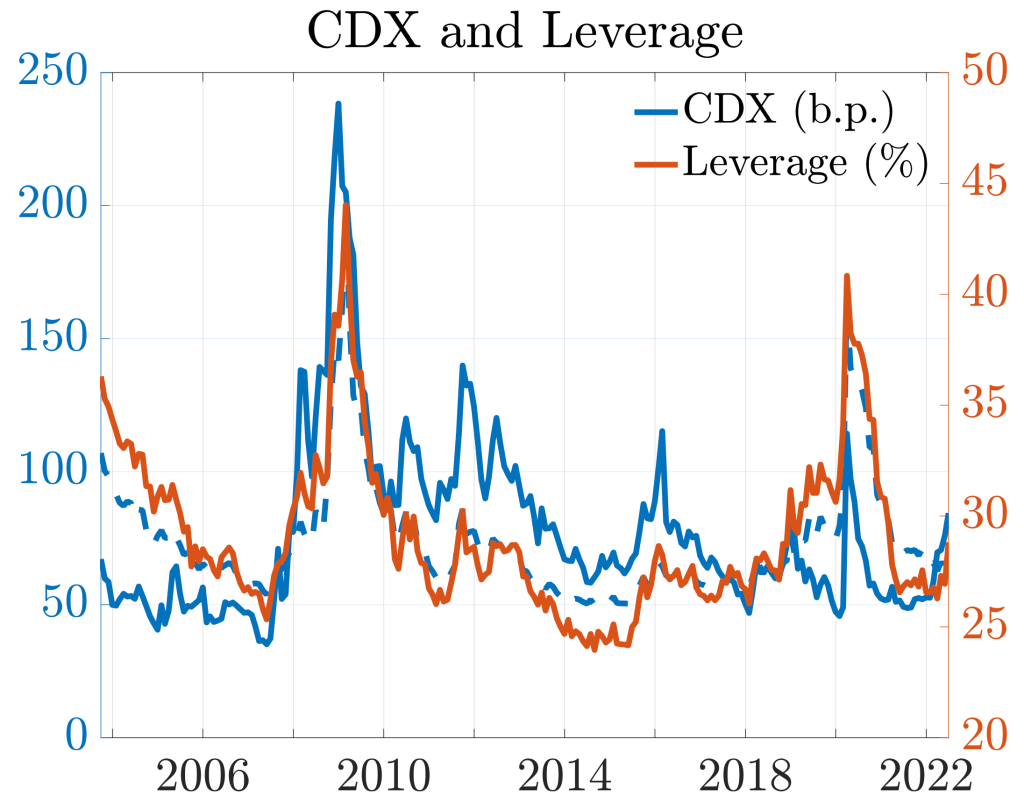

Standard credit derivative models typically assume exogenous corporate policies and rational expectations about systematic risk. We show that subjective beliefs about disaster risk, specifically their level, not just uncertainty, drive CDX (credit default swap index) rates through endogenous corporate responses. In a consumption-based model with Epstein-Zin preferences, firms optimally choose leverage and default boundaries while learning about disaster probabilities. When disaster risk beliefs rise, the model generates a feedback effect: higher perceived risk leads to higher optimal default boundaries, decreasing distance-to-default and raising leverage, which sustains elevated credit spreads even after uncertainty resolves. Estimating on CDX data from 2003-2022, we match both the level and time variation of investment-grade spreads and leverage ratios. The model replicates the 1-to-10 year term structure of CDX spreads in out-of-sample tests.