Model implied capital misallocation

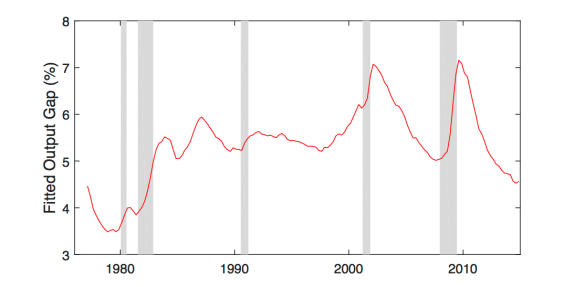

The goal of this paper is to quantify the cyclical variation in firm-specific risk and study its aggregate consequences via the allocative efficiency of capital resources across firms. To this end, we estimate a general equilibrium model with firm heterogeneity and a representative household with Epstein-Zin preferences. Firms face investment frictions and permanent shocks, which feature time-variation in common idiosyncratic skewness. Quantitatively, the model replicates well the cyclical dynamics of the cross-sectional output growth and investment rate distributions. Economically, the model generates business cycles through inefficiencies in the allocation of capital across firms, which amounts to an average output gap of 4.5% relative to a frictionless model. These cycles arise because (i) permanent Gaussian shocks give rise to a power law distribution in firm size and (ii) rare negative Poisson shocks cause time-variation in common idiosyncratic skewness. Despite the absence of firm-level granularity, a power law in the firm size distribution implies that large inefficient firms dominate the economy, which hinders the household’s ability to smooth consumption.

Conference presentations: 6th Advances in Macro-Finance Tepper-LAEF Conference, 1st Arizona Junior Finance Conference, 2016 Duke-UNC Asset Pricing Conference, 2016 Society for Economic Dynamics Meeting, 2016 European Finance Association Meeting, 2016 BYU Red Rock Finance Conference, 2017 American Economic Association Meeting, 2017 Western Finance Association Meeting